Category: Senza categoria

Nov 18

STARTUP PRE-SEED STAGE: FINANCING AND ADVISORY – Part 2

Notes from an event organized at Open Milano on Wednesday 16 November 2016, by English Corner with the collaboration of Team2Grow, and The Vortex.

This is the second part of our posts about startups in the pre-seed stage, where we continue with the discussion about financing and advisory.

How feasible and realistic is it to access know-how and experience early on? Why is it needed? And how does the right advice improve the chances of getting the”numbers” right, making fewer mistakes, which improves the chances of finding investors and, ultimately, survival.

We suggest the startup needs to attract experienced professional managers. Early on, as soon as possible.The presence of people with managerial expertise will help to gain time, to avoid reinventing the wheel and possibly to avoid expensive mistakes. Some mistakes could cripple a startup.

The roles may be different, for example, in the pre-seed stage it could be in the role of a mentor, in the seed stage as an advisor or a mentor, in the scale-up stage possibly as a manager and as a team member.

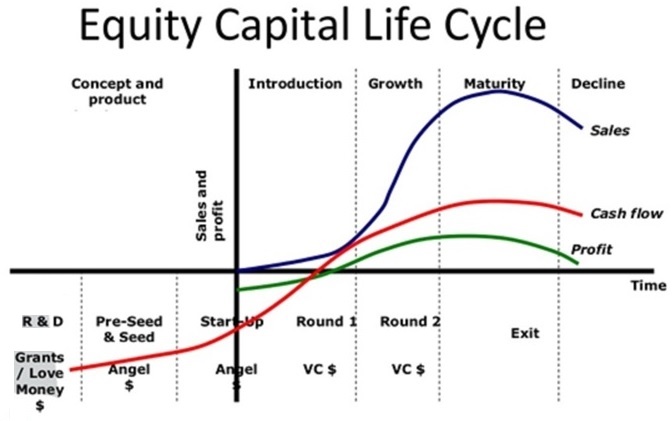

So, how do we move from the pre-seed stage to seed stage, on this graph?

Practically this means, being attractive as a startup for people wanting to invest, and being able to prove that you and your team are a candidate “future winner”! (Read: team, BP, metrics etc.etc.)

Also, the right know-how needs to be available to the startup, and depending on the complexity to manage, may be needed on-board. This is perfectly accessible through mentors in the pre-seed stage, and advisors in the seed (startup) stage.

To help you to get the following aspects right which are all relevant to a correct valuation.

Factors towards Startup Valuation (and being attractive as a startup)

- Original idea and not a derivative

- A credible Business Plan

- Personalities of the founders and the future CEO, Initiative / Energy – essential 100% “on the ball”

- Ability to listen and adapt, coachability

- Demonstrated initiative in finding and tapping into funds

- Ability to win prizes to attract attention

- Interesting but not indispensable: previous startup experience, pedigree

- The Pitch

- Last but not least, does your product/service work? and do people want to buy it?

There are, therefore, a number of things that you need to get right, with the help of your mentor, or advisor. As we said you need to prove that the startup is a fantastic investment opportunity!

Critical Points of both Pre-Seed and Seed Financing (more relevant, still, in the seed stage)

- The leap from pre-seed to seed, will occur only if there are credible metrics and a demonstrable traction*

- Customer acquisition cost vs. Life time value

- Revenue per customer

- Activation rate

- Repeat sales

- It requires a very interesting market, ie: either a new market or a fast growing market

- Solid and complementary team, experienced

- The negotiation with the funds tend to be unilateral

- Equity costs much more than debt capital (c.a + 30%), so do finance with debt, if possible

*What is Traction? Quantitative evidence of market demand. Proof that people want your product. It communicates momentum in market adoption. E.g. active users, transactions, revenue growth, etc.

So metrics are the same for everybody, and universally applicable? Not exactly.

The right metrics to use will change with the type of business a startup operates in. For more information on this topic, please read (and follow) my blog Pre-Seed Investing in Startups.

And especially we recommend the post about metrics for decision making, #Metrics for decision making vs vanity metrics.

In our next post we will look at mentors vs. managers, and the expertise and know-how they can bring to the startup. Why you need to actively search this as early-on as possible.

Tags:

If you like this post, you may want to see more of it on Facebook? Consultancy and advisory #GroetConsulting Accelerator with mentors #LAB Creative Thinking Pre-seed financing #Creative Thinking Ventures

Leave Your Comment Here